Investor Relations

Stay Informed with the Latest Financial Updates

Why become a unitholder in Dubai Residential REIT

Investing in Dubai Residential REIT means becoming a unitholder in the GCC’s largest listed REIT, with a Gross Asset Value (GAV) of AED 23.5 billion, more than double the combined GAV of the next five largest listed REITs in the region. It is also the first listed REIT in the GCC focused exclusively on residential leasing. This offers investors a unique opportunity to participate in Dubai’s growth story through a well-managed, diversified portfolio that has been carefully curated over more than two decades. With a track record of resilient financial and operational performance, Dubai Residential REIT is strongly positioned to deliver sustainable, long-term value to its unitholders.

-

Superior UAE macro fundamentals driving continued economic outperformance

- Strong UAE economic performance and robust Dubai population growth in recent years have positively influenced the residential real estate market.

- GDP growth outpacing other GCC nations and Western Europe and Dubai’s population increasing at 2.7% annually from 2018 to 2023.

- Strategic initiatives, such as the Dubai 2040 Urban Master Plan and Dubai Economic Agenda D33, aim to grow the economy significantly and enhance living environments.

- Coupled with innovative visa programs like the Golden Visa and supportive social reforms, Dubai continues to attract global talent and investors, reinforcing its status as a premier destination to live, work, and invest.

-

Positive residential leasing market dynamics with ongoing structural shifts

- The REIDIN Residential Index for Dubai saw significant growth from Q1 2021 to the end of Q4 2024, rising by 17% annually. This increase was driven by rental rate growth across both apartments and villas, which grew annually by 17% and 18%, respectively.

- The increase in rental demand has been driven by sustained economic and employment growth, rising household incomes, population expansion, and increased housing demand due to long-term visa and residency programs.

- This upward population trend is expected to support occupancy rates, which are projected to remain stable at 80–90% through 2030, even with the addition of over 200,000 new housing units.

- Over 60% of lease transactions come from renewals—supported by capped annual rent increases under RERA regulations, making them more attractive than new leases. Given these dynamics, Dubai Residential REIT is expected to continue to maintain high occupancy rates and reserve the flexibility to increase rents, given relatively inelastic demand.

-

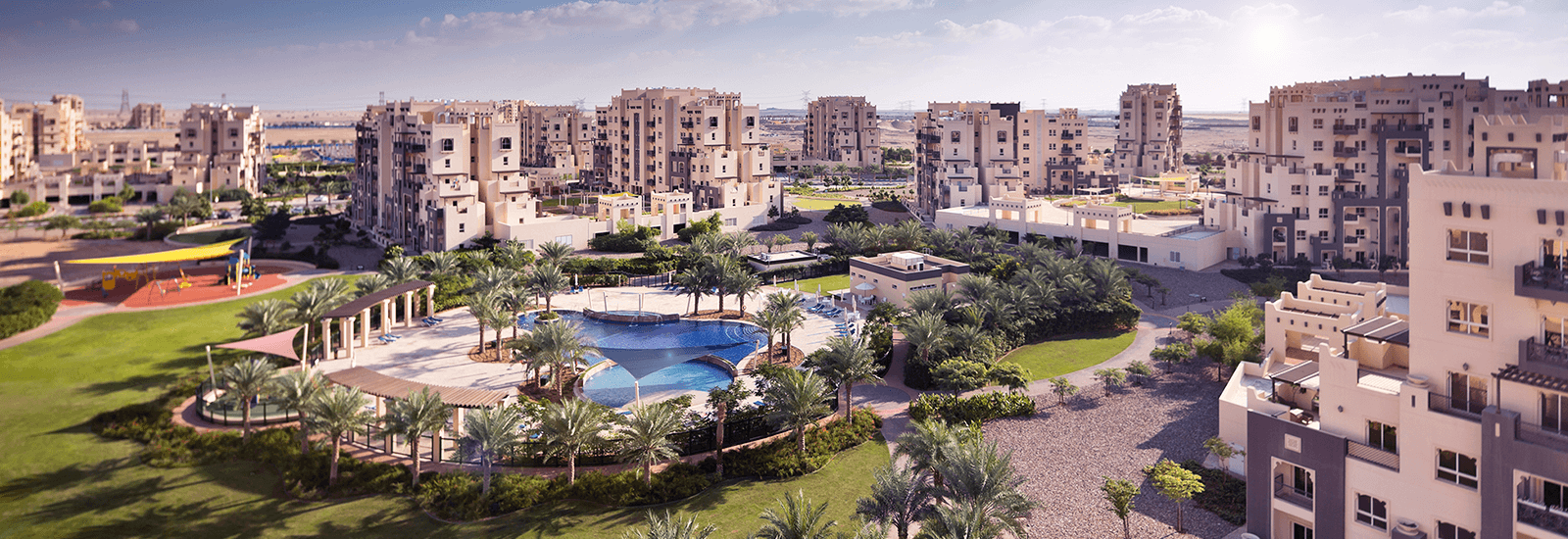

Benchmark for Dubai’s residential real estate market and a high-quality diversified platform

- Dubai Residential REIT is expected to be the GCC’s first pure-play residential REIT as well as the largest REIT in the GCC, with 35,700 residential units under management and a GAV of AED 21.6 billion, almost double the combined GAV of the five largest REITs in the region.

- Accounting for approximately 6% of Dubai’s rental transactions and 3% of total rental value as of the end of December 2024, it showcases Dubai Residential REIT’s extensive reach and breadth of scale, positioning it as the benchmark for Dubai’s residential real estate market.

- Dubai Residential REIT’s diversified portfolio—spanning various locations, property types, and segments such as Premium, Community, Affordable, and Corporate Housing—combined with a well-balanced tenant mix of 57% individual tenants (primarily families) and 43% corporates, ensures stable cash flows and consistent operating margins.

-

Active asset management driving stable and resilient operating performance

- Dubai Residential REIT’s seasoned teams ensure stable and resilient operations through active asset management, focusing on value creation, maximising cash flows, tenant engagement, and risk mitigation.

- This approach is reflected in the track record of the team, having increased average occupancy from 93% in 2022 to 97% by December 2024.

- During the same period, new lease rates rose annually by 19% (Premium), 14% (Community), and 12% (Affordable), while maintaining an impressive average retention rate of 87% FY2024.

-

Robust cash generation and attractive intended dividend policy

- Dubai Residential REIT has demonstrated strong cash generation, driven by topline growth, improving margins, and high cash flow conversion rates.

- Despite ongoing capital expenditures to maintain asset quality, its real estate portfolio continues to generate strong free cash flow, benefiting from the recent completion of major investment programs.

- With a prudent capital structure and conservative leverage policy, Dubai Residential REIT maintains strategic flexibility and cost optimisation across market cycles.

- These factors are expected to enable Dubai Residential REIT to deliver attractive investor returns, with a targeted dividend payout ratio of at least 80% of profit before changes in the fair value of investment property.

-

Tangible organic growth with sizeable inorganic upside potential

- Dubai Residential REIT’s competitive position is further strengthened by its strategic alignment with Dubai Holding, Dubai’s leading investor, real estate developer and asset manager.

- As part of its ecosystem, Dubai Residential REIT benefits from the Dubai Holding Group’s broad capabilities within the real estate sector, including development, asset management, facilities management and community management.

- Dubai Residential REIT will also benefit from the Fund Manager’s experienced management team from DHAM, which has a proven track record of developing, financing, managing and operating institutional grade built-to-lease residential assets in Dubai’s key large scale master plans.

-

Strategic alignment with one of Dubai’s leading investors, developers and asset managers

- Dubai Residential REIT is pursuing a growth strategy that combines tangible organic growth with a strong potential for inorganic expansion.

- Organic growth is expected to be driven by rental rate increases, portfolio efficiencies, and market trends, while inorganic initiatives focus on acquiring new properties and leveraging the right of first offer (ROFO) granted to Dubai Residential REIT in respect of DHAM-owned prime real estate projects.