Stay Informed with the Latest Financial Updates

Who we are

Dubai Residential REIT is a Shariah-compliant income-generating closed-ended real estate investment fund and one of the largest owners and operators of residential real estate in Dubai. Dubai Residential REIT is managed by DHAM REIT Management LLC, a dedicated fund manager wholly owned by Dubai Holding.

As the largest listed REIT in the GCC, it manages a diverse portfolio of 21 residential communities with 35,700 units, housing over 140,000 residents across a range of demographic segments. Notably, it is the only pure-play residential REIT, offering a unique focus on the residential leasing market. Benefiting from Dubai Holding’s broader ecosystem, Dubai Residential’s GAV exceeds AED 23.5 billion, surpassing the combined GAV of the next five largest listed REITs in the region. The strategic positioning of Dubai Residential REIT's portfolio across major residential hubs minimises exposure to any single location or tenant type, thereby enhancing resilience and maintaining stable occupancy rates.

What we do

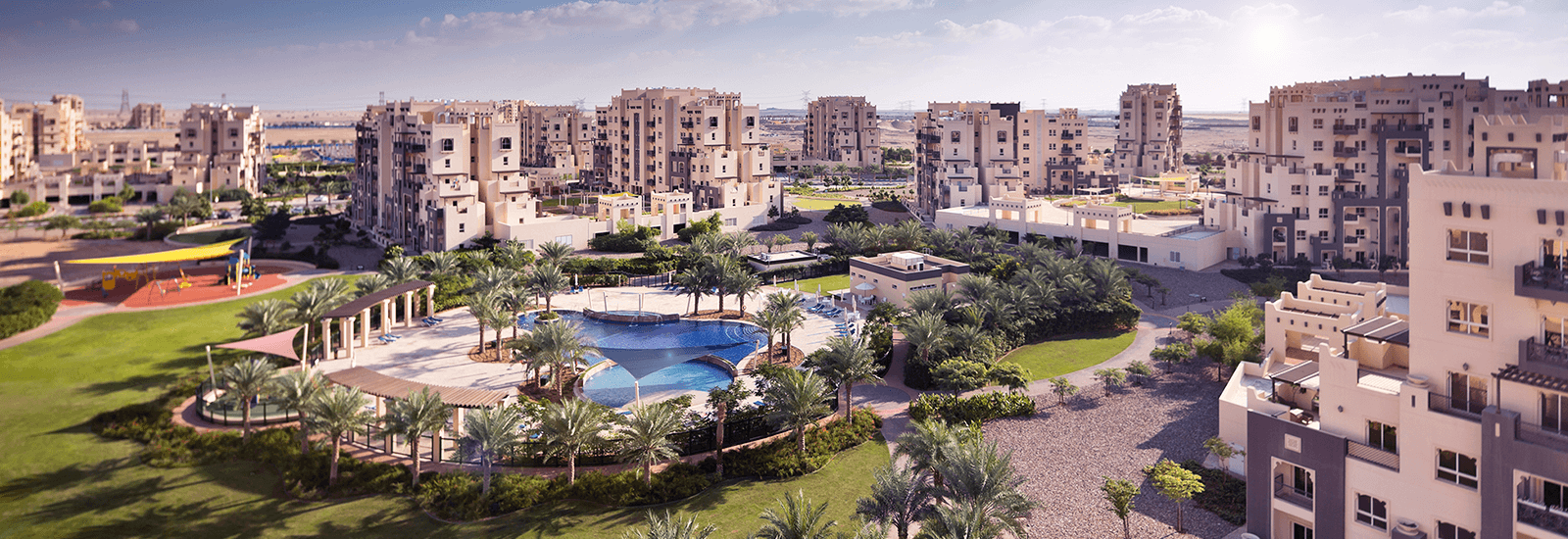

Dubai Residential REIT, through DHAM REIT Management LLC, invests in, owns, and professionally manages a diversified portfolio of income-generating residential communities across Dubai. The portfolio spans four distinct segments, each tailored to meet the needs of a broad spectrum of residents. The Premium segment includes upscale properties in prime locations such as Bluewaters, City Walk, and Nad Al Sheba Villas, renowned for their vibrant lifestyle offerings and superior amenities.

The Community segment caters to mid- to high-income families, featuring amenity-rich, gated communities like Shorooq and Layan. For more budget-conscious residents, the Affordable segment provides quality, cost-effective housing in areas such as Al Khail Gate and International City. Additionally, the Corporate Housing segment delivers purpose-built accommodations designed to support the residential needs of corporate and industrial staff. Together, these offerings illustrate the REIT’s comprehensive approach to residential leasing, reflecting the diversity of Dubai’s growing population. Through active asset management, operational efficiency, and a tenant-focused approach, Dubai Residential REIT consistently delivers resilient performance and sustainable long-term value to its unitholders.

-

+140KResidents

-

35,700Residential Units (95% Apartments / 5% Villas)

-

21Dynamic Communities

(1) Adjusted EBITDA: Profit for the period plus finance costs – net, and depreciation and amortization, before gain on fair value of investment property, before allocated corporate costs and management fee.

(2) GAV: As per JLL’s valuation report as of 31 Dec 2025

(3) Excludes retail units.

(4) Average Occupancy Rate: Defined as leased units during the period divided by available units during the period

(5) Retention Rate: Defined as percentage of total tenants that renew their leases during the period.

Dividend Policy

Dubai Residential REIT follows a semi-annual dividend distribution policy, with payments in April and September each year, consistent with its commitments at the time of the Initial Public Offering.

The REIT successfully distributed an interim cash dividend of AED 550 million for H1 2025 in September 2025.

As previously announced, the sum of the first two dividend payments, September 2025 and April 2026, in respect of the financial results for the year ending 31 December 2025 will be the higher of:

- AED 1,100 million; or

- 80% of profit before changes in the fair value of investment property for FY25.

For FY 2026 and subsequent periods, the REIT intends to distribute at least 80% of profit before changes in fair value of investment property for each accounting period semi-annually, subject to Board approval.